The Power of Diversification in Investment

"So lots of times if somebody points something out it helps me, and I want to have a diversified bet of uncorrelated bets." - Ray Dalio.

While Warren Buffet is quoting diversification as "Protection against Ignorance", On other hand Ray Dalio, Founder of World's largest hedge fund, keeps distributing the idea of All- weather portfolio theory through diversification. After a research, I wrote this article and it is not about who is right or who is wrong. In fact, It is based on idea of defining principles of meritocracy where both of these pioneers are right based on their reasoning and merits of their Idea.

Basically, There are two ways of approaching the market, one being discretionary and other being Mechanical or Quantitative approach. Dalio's diversification techniques is more leaned towards the quantitative approach. To analyze Dalio's All weather portfolio theory, I decided to dig in to the historical prices on different securities and analyze it through basic portfolio theory's model.

Research on Dalio's All weather portfolio theory.

Inputs:

In order to analyze the theory, I created a portfolio consisting seven Assets; Amazon (AMZN), Intel (INTC), Coca-cola (KO), 20+ years Treasury Bond (TLT), Gold (GLD), High Yield Corporate bond ( HYG) and MSCI emerging market ETF (IEMG).

The first requirement to build this portfolio was to pick uncorrelated stocks, The correlation between these assets is given below:

Procedure:

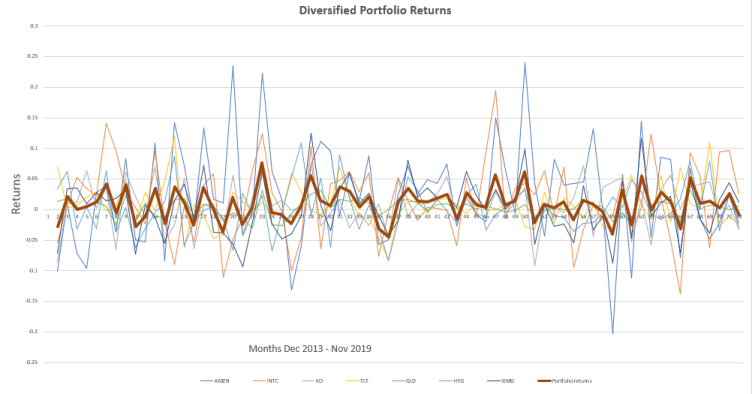

This research is based on historical monthly price data from Dec 01, 2013 to Nov 01, 2019 obtained from Yahoo Finance website. The prices were adjusted to dividend or any stocks split occurred during the interval.

After obtaining Price data; the average, variance and Standard deviation of monthly returns were calculated on each individual assets. As of seven assets, I placed them equally weighted on Portfolio i.e 14.3% of portfolio value for each of them. Then after, the Weighted returns on portfolio for each assets were calculated and the outcome was striking.

Results:

Lets focus on the column "Average" on first picture and "Overall Stats of Portfolio" on second picture. Here we observed that we have reduced our risk (i.e variance) and Volatility (i.e Standard deviation) of the portfolio without undermining the returns (i.e Average returns) which we can also visualize in picture below; brown bold line being the average overall portfolio's monthly return.

The notion that combination of all asset's statistical property in a portfolio should be equal to overall statistics of portfolio had failed in here.

Why is it so? Because, the assets were not perfectly correlated with each other.

In conclusion, We can reduce our risk without reducing our return if we choose uncorrelated assets in our portfolio and that's the power of diversification.